AbraSilver Resource – Key Takeaways From The Updated PFS At The Diablillos Silver-Gold Project

John Miniotis, President and CEO, and Jeremy Weyland, Senior VP of Projects and Development of AbraSilver Resource Corp (TSX.V:ABRA – OTCQX:ABBRF), both join me to review the results of their updated Pre-Feasibility Study (“PFS”) for the Diablillos silver-gold project, located in Salta Province, Argentina.

PFS Study Highlights:

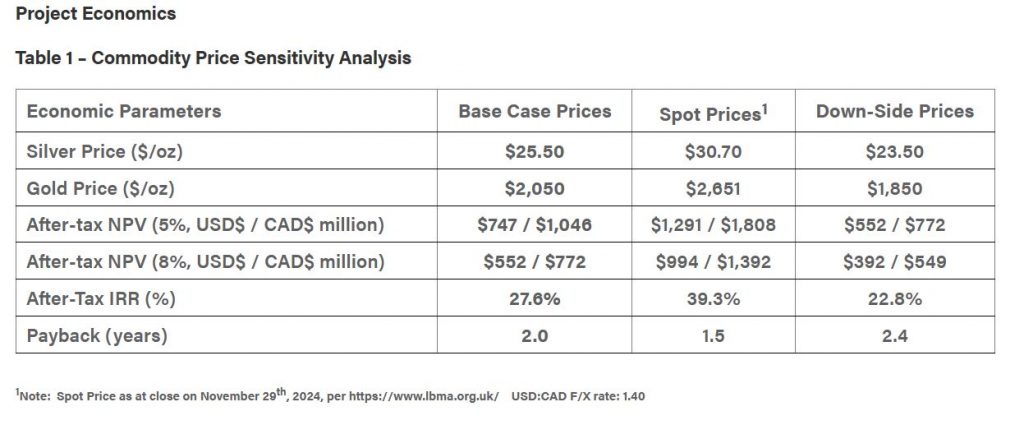

All dollar ($) figures are presented in US dollars unless otherwise stated. Base case metal prices used in the PFS are $2,050 per gold (“Au”) ounce (“oz”) and $25.50 per silver (“Ag”) oz.

- Attractive project economics: 747 million after-tax Net Present Value discounted at 5% per annum (“NPV”); 27.6% Internal Rate of Return (“IRR”) and 2.0-year payback period.

- At current spot prices1 an after-tax NPV5% of $1,291 million with an IRR of 39.3% and payback of 1.5 years.

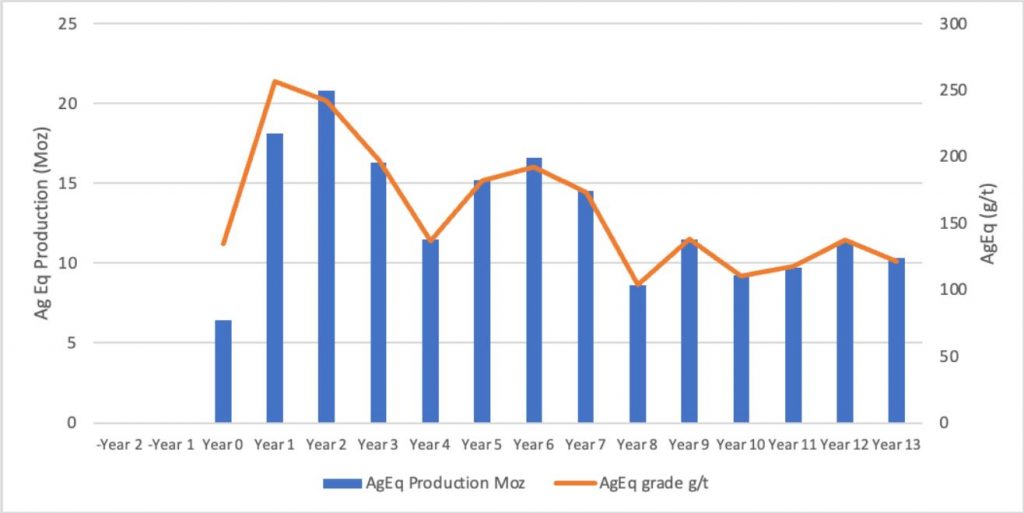

- Substantial silver and gold production – 13.4 Moz silver-equivalent “AgEq”) average annual production over a 14-year life-of-mine (“LOM”), comprised of 7.6 Moz Ag and 72 koz Au, with average annual production of 16.4 Moz AgEq over the first five years of full mine production, comprised of 11.7 Moz Ag and 59 koz Au.

- Low All-in Sustaining Cash Costs (“AISC”)– Average AISC of $12.67/oz AgEq over LOM, and $11.23/oz AgEq over the first five years of full mine production.

- Initial capital expenditures – Initial pre-production capital expenditure of $544 million (including contingency)with a further $77 million in sustaining capital over the LOM.

- Significant potential for additional economic improvements:

- Replacement of on-site self-generation from a combined solar-diesel power plant with a connection to the national grid under a long-term power purchase agreement from a third party. Capturing this opportunity would provide a meaningful reduction to initial capital, lower operating costs and, potentially, improve the carbon footprint of the Project.

- A revised mine plan based on a new Mineral Resource and Reserve estimate that incorporates the additional Phase IV exploration drilling results at JAC and the northeast zone of Oculto as well as higher metal price assumptions. A new mine plan may present the opportunity to reduce strip ratio, and improve operating cashflow.

- Expansion of available water resources to the Project to remove constraints on plant throughput resulting in increased metal production.

- Treatment of marginal material currently classified as waste through secondary processing, such as heap leaching, resulting in increased metal production.

- Improvements to the design of the Tailings Storage Facility (“TSF”) to reduce capital and operating cost, and also decrease the environmental footprint.

Jeremy unpacks the benefits to the economics and from the Incentive Regime for Large Investments (“RIGI”) legislation passed by the Argentinean congress in July, 2024. The key incentives include a reduction of the federal corporate income tax rate from 35% to 25%; the elimination of export duties levied on gold and silver sales respectively; and accelerated tax depreciation of plant and equipment. He walks us through the timeline for qualifying projects with expenditures above $200M applying for RIGI before the law expires in July, 2026. AbraSilver will apply after they receive their EIA, and then the Company must spend 40% of the investment amount within two years of approval (by no later than July 2028). Diablillos meets all of the required qualifications for RIGI. The PFS considers an execution plan to obtain RIGI approval by no later than Q2 2026, giving the Project until Q2 2028 to spend 40% of the investment, or approximately $200M.

John wraps us up with all the exploration catalysts to come from the ongoing 20,000 meter Phase 4 diamond drill campaign on their wholly-owned Diablillos property, which has continued to extend mineralization at both the JAC Zone and Occulto NE, as well as a new discovery made outside of the known resources at the Sombra Target, the drilling at Cerro Bayo, and the copper-gold porphyry targets at Cerro Blanco and Cerro Viejo.

If you have any follow up questions for John or Jeremy regarding at AbraSilver, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver at the time of this recording.

.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

.